Investing can often feel like navigating a complex maze, especially for those who are new to the world of finance. One popular choice among investors is the Vanguard Total Stock Market Index Fund (VTSAX), which aims to provide broad exposure to the U.S. stock market. Understanding the performance of VTSAX returns by year can help investors make informed decisions about their portfolios and future investments. In this article, we will delve into the annual returns of VTSAX, analyze its historical performance, and provide insights into what these returns mean for potential investors.

For those considering investing in VTSAX, it is crucial to understand how it has performed historically. The returns can significantly influence an investor's decision-making process, especially when compared to other investment vehicles. By examining VTSAX returns by year, investors can identify trends and patterns that may inform their investment strategies. Additionally, understanding the factors that contribute to the fund's performance can help investors set realistic expectations for future returns.

As we explore VTSAX returns by year, we will also address common questions that arise among investors. This comprehensive guide aims to equip you with the knowledge needed to navigate the complexities of investing in VTSAX. Whether you are a seasoned investor or just starting, understanding the historical returns of this fund can provide valuable insights and help you make informed decisions about your investment portfolio.

What is VTSAX?

Vanguard Total Stock Market Index Fund (VTSAX) is a mutual fund designed to track the performance of the CRSP US Total Market Index, which includes nearly all publicly traded companies in the United States. This fund provides investors with a simple and effective way to gain exposure to the entire U.S. stock market, encompassing large, mid, small, and micro-cap stocks. VTSAX is managed by Vanguard, a well-respected investment management company known for its low-cost investment options.

How Does VTSAX Generate Returns?

The returns generated by VTSAX come from two primary sources: capital appreciation and dividends. Capital appreciation occurs when the price of the stocks held within the fund increases over time. Dividends are payments made by the companies within the fund to their shareholders, which can also contribute to the overall return of the fund. Investors in VTSAX benefit from both sources of return, making it an attractive option for those looking to invest in the U.S. stock market.

What Have VTSAX Returns Been by Year?

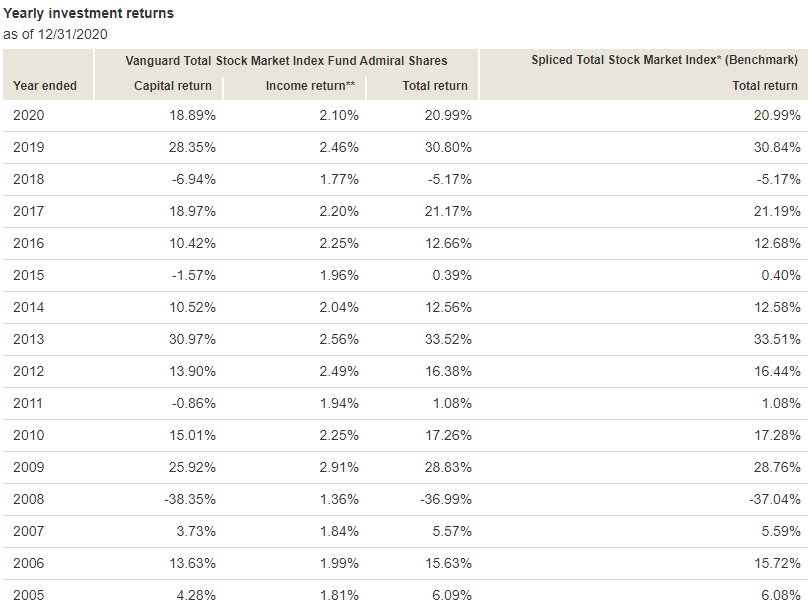

Understanding VTSAX returns by year is crucial for evaluating its historical performance. Below is a table illustrating the annual returns of VTSAX over the past decade:

| Year | Annual Return (%) |

|---|---|

| 2013 | 33.4% |

| 2014 | 12.6% |

| 2015 | 0.5% |

| 2016 | 12.7% |

| 2017 | 21.6% |

| 2018 | -5.2% |

| 2019 | 30.7% |

| 2020 | 20.0% |

| 2021 | 26.5% |

| 2022 | -18.1% |

How Do VTSAX Returns Compare to Other Funds?

When evaluating VTSAX returns by year, it is essential to compare its performance to other similar investment options. For example, comparing VTSAX to other index funds or actively managed funds can provide investors with a clearer understanding of its strengths and weaknesses. Generally, VTSAX has performed well compared to its peers, but there are instances where other funds may have outperformed it in specific years.

What Factors Affect VTSAX Returns?

Several factors can influence VTSAX returns, including:

- Market Conditions: The overall performance of the U.S. stock market significantly impacts VTSAX returns.

- Economic Indicators: Metrics such as GDP growth, unemployment rates, and inflation can also affect stock market performance.

- Interest Rates: Changes in interest rates can influence investor sentiment and market performance.

- Global Events: Political events, natural disasters, and other global occurrences can create volatility in the stock market, impacting VTSAX returns.

What Should Investors Consider When Analyzing VTSAX Returns by Year?

When analyzing VTSAX returns by year, investors should keep several key factors in mind:

- Consider the long-term trends rather than focusing solely on short-term fluctuations.

- Understand the impact of economic conditions and market cycles on the fund's performance.

- Compare VTSAX returns with those of similar funds for a more comprehensive evaluation.

- Keep in mind that past performance is not indicative of future results.

What Are the Long-Term Prospects for VTSAX?

While analyzing VTSAX returns by year provides valuable insights, investors should also consider the long-term prospects for the fund. Historically, VTSAX has demonstrated strong performance over extended periods, making it a popular choice for long-term investors. The fund's low expense ratio and broad market exposure contribute to its appeal, suggesting that it may continue to be a solid investment option for those looking to build wealth over time.

How Can Investors Use VTSAX Returns in Their Investment Strategy?

Investors can utilize VTSAX returns by year to inform their investment strategies in several ways:

- Evaluate the fund's performance relative to their investment goals and risk tolerance.

- Determine the appropriate allocation of VTSAX within their overall portfolio.

- Stay informed about market trends and economic indicators that may impact future returns.

- Adjust their investment strategy based on the historical performance of VTSAX.

Conclusion: Is VTSAX the Right Investment for You?

In conclusion, understanding VTSAX returns by year is crucial for making informed investment decisions. By analyzing its historical performance, comparing it to other funds, and considering the factors that affect returns, investors can better assess whether VTSAX aligns with their financial goals. Ultimately, the decision to invest in VTSAX should be based on individual circumstances, risk tolerance, and long-term investment strategies. With its strong historical performance and broad market exposure, VTSAX continues to be a compelling option for investors seeking to build wealth over time.